Minimum Bank Statement For Sweden Schengen Visa April 2025

Sweden, with its stunning landscapes, rich cultural heritage, and advanced infrastructure, remains a top destination for travelers worldwide. For Pakistani citizens and other non-EU nationals, securing a Sweden Schengen visa is essential for visiting Sweden. One of the most critical requirements for obtaining this visa is proving financial stability. The Swedish authorities require applicants to demonstrate sufficient funds to cover their stay, ensuring they do not become financially dependent while in Sweden.

A bank statement serves as a crucial document in this process. It reflects the applicant’s financial health, stability, and ability to bear all expenses during their stay. Understanding the minimum bank statement requirements and how to meet them is essential for a successful visa application. This guide provides a comprehensive overview of the financial prerequisites for obtaining a Sweden Schengen visa in April 2025.

Sweden Schengen Visa Financial Requirements

General Financial Prerequisites

To obtain a Sweden Schengen visa, applicants must provide financial proof showing they can support themselves during their visit. The Swedish Migration Agency sets specific guidelines to ensure visitors have adequate funds to cover accommodation, food, transportation, and other daily expenses.

Why Proof of Funds is Essential for Visa Approval

Sweden, like other Schengen states, enforces financial proof requirements to:

-

Prevent overstays due to financial hardship.

-

Ensure visitors can support themselves without engaging in unauthorized employment.

-

Verify that applicants genuinely intend to return to their home country after their visit.

Minimum Bank Statement Requirement for Sweden Schengen Visa (April 2025)

Updated Minimum Balance Requirement

As of April 1, 2025, the Swedish authorities require a minimum of 450 SEK per day for each traveler. This amounts to:

-

13,500 SEK for a 30-day stay.

-

Approximately PKR 350,000 based on the exchange rate.

Required Duration of Bank Statement History

Applicants must provide bank statements covering at least the last three months before the application date. These statements must:

-

Be issued by a reputable bank.

-

Show a steady inflow and outflow of funds.

-

Reflect a consistent minimum balance that meets the visa requirements.

Factors Affecting the Required Bank Balance

Length of Stay and Daily Expense Calculations

The amount required depends on the length of stay. If an applicant plans a shorter visit, the total required funds will be lower, but still calculated at 450 SEK per day. Applicants staying longer than 30 days must adjust their financial proof accordingly.

Visa Type (Tourist, Business, Student) and Financial Expectations

Different types of Schengen visas have varying financial requirements:

-

Sweden Tourist Visa: Requires proof of accommodation, transport, and general expenses.

-

Sweden Business Visa: May require company sponsorship proof or employer financial backing.

-

Student Visa: Requires proof of tuition fees, living expenses, and financial sponsorship (if applicable).

Cost of Living in Sweden and Its Impact on Financial Proof

Sweden has a higher cost of living than many other European nations. The minimum financial requirement is based on expected daily expenses, including:

-

Accommodation: 1000-2000 SEK per night.

-

Food: 200-400 SEK per day.

-

Transportation: 50-150 SEK per day.

-

Miscellaneous expenses: 100-200 SEK per day.

How to Calculate the Required Bank Balance

Breakdown of Estimated Daily Expenses

A standard calculation for a 30-day stay in Sweden includes:

-

450 SEK per day x 30 days = 13,500 SEK (minimum requirement).

-

Additional buffer funds for unexpected costs.

Additional Reserves for Emergencies

Swedish authorities recommend that applicants maintain a higher balance than the minimum required amount to cover emergencies such as:

-

Medical expenses.

-

Extended stays due to flight delays.

-

Unexpected additional travel costs.

Alternative Proofs of Financial Stability

If an applicant lacks a personal bank statement that meets the financial requirements, they may submit alternative documents:

-

Sponsorship letter from a relative or employer.

-

Bank guarantee letter confirming available funds.

-

Salary slips and employment verification for working professionals.

-

Property ownership documents demonstrating financial stability.

-

Fixed deposits or investment accounts with liquid assets.

Common Reasons for Visa Rejection Due to Bank Statements

Inconsistent Account Transactions

-

Frequent large deposits and withdrawals can raise suspicion.

-

Irregular salary payments may cause doubts about financial stability.

Sudden Large Deposits Raising Suspicion

-

A sudden influx of funds right before applying can indicate an attempt to meet visa requirements artificially.

-

Applicants should maintain a stable balance for several months before applying.

Submission of Unverified or Outdated Documents

-

Statements older than three months may be rejected.

-

Statements without bank stamps and official verification can lead to disqualification.

Best Practices for Submitting a Bank Statement

Ensuring Authenticity and Official Verification

Applicants must:

-

Obtain original bank statements with bank stamps.

-

Include contact details of the issuing bank.

-

Ensure all information matches other submitted documents.

Need for Translations if Statements Are Not in English or Swedish

If bank statements are in a local language (such as Urdu), an official English or Swedish translation must be provided.

Supplementary Documents to Strengthen Financial Credibility

To enhance an application, it is advisable to include:

-

Tax returns for the last two years.

-

Proof of employment or business ownership.

-

Letter from employer confirming salary and leave approval.

Financial Planning Tips for a Successful Visa Application

Maintaining a Stable Balance for Several Months Before Applying

Applicants should avoid major fluctuations in their bank balance. Keeping an average daily balance above the minimum requirement is advisable.

Avoiding Red Flags in Financial Records

-

Avoid taking loans or making abrupt transfers right before applying.

-

Ensure regular income deposits from verified sources.

Seeking Expert Guidance for Visa Document Preparation

Consulting a visa expert or financial advisor can help applicants:

-

Understand current financial requirements.

-

Avoid common pitfalls leading to visa rejection.

-

Properly structure financial documentation for submission.

Key Notes

The Sweden Schengen visa application process requires meticulous financial planning. Submitting a well-prepared bank statement with stable financial history increases the chances of visa approval. Applicants should ensure they maintain a minimum balance of 13,500 SEK for a 30-day stay, avoid sudden financial changes, and submit properly verified documents. By following these financial guidelines, travelers can navigate the Schengen visa process with confidence and look forward to an enriching experience in Sweden.

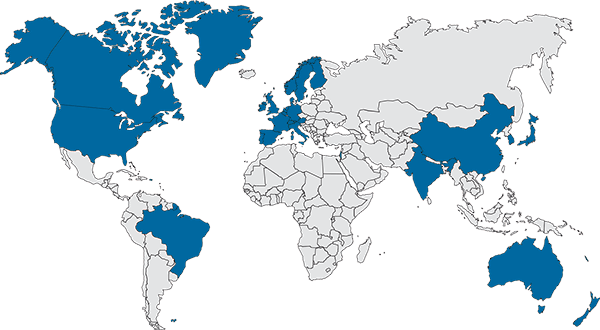

Worldwide Visa Information for Pakistani Passport: