Pak Cardholders Can Now Add Their Visa Card To Google Wallet

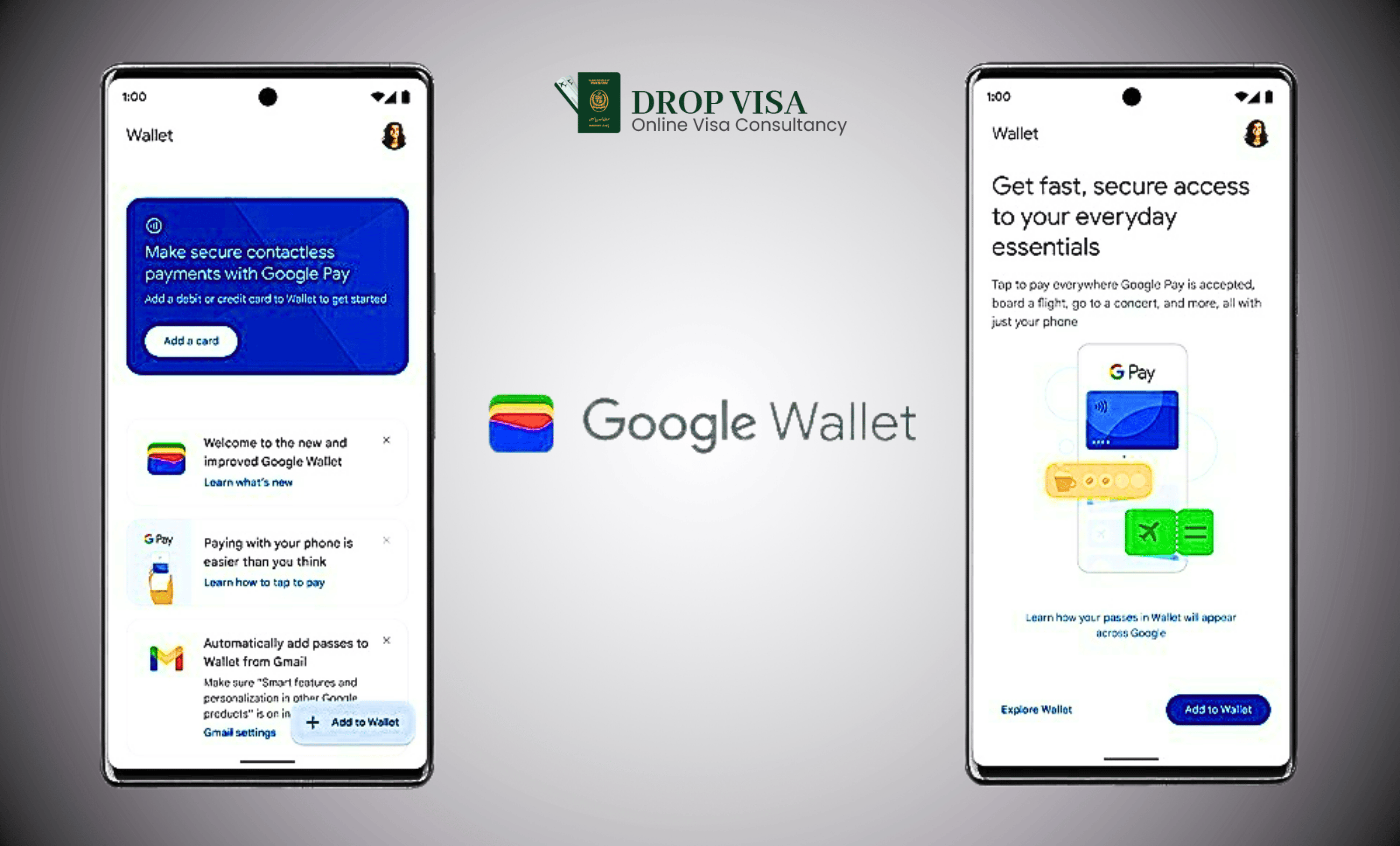

In a major breakthrough for Pakistan’s financial sector, Visa announced that Pakistani cardholders could now integrate their Visa cards with Google Wallet. This integration marks a significant step toward digital payments adoption in the country, enabling secure, seamless, and contactless transactions. With Pakistan's growing digital economy, this move is expected to significantly impact the way consumers make local and international transactions.

Key Highlights

- Launch Date: March 13, 2025

- Eligible Banks: HBL, Bank Alfalah, UBL, and Meezan Bank

- Upcoming Banks: JS Bank, Allied Bank, Zindigi, and Easypaisa

- Supported Devices: Android and Wear OS

- Technology Used: Tokenization for enhanced security

- Payment Acceptance: Anywhere contactless payments are supported

- Launch Date: March 13, 2025

- Eligible Banks: HBL, Bank Alfalah, UBL, and Meezan Bank

- Upcoming Banks: JS Bank, Allied Bank, Zindigi, and Easypaisa

- Supported Devices: Android and Wear OS

- Technology Used: Tokenization for enhanced security

- Payment Acceptance: Anywhere contactless payments are supported

The Digital Payment Revolution in Pakistan

- Launch Date: March 13, 2025

- Eligible Banks: HBL, Bank Alfalah, UBL, and Meezan Bank

- Upcoming Banks: JS Bank, Allied Bank, Zindigi, and Easypaisa

- Supported Devices: Android and Wear OS

- Technology Used: Tokenization for enhanced security

- Payment Acceptance: Anywhere contactless payments are supported

Benefits for Cardholders

1. Contactless Transactions

Google Wallet allows Visa cardholders to make tap-and-pay transactions at thousands of merchants nationwide and globally. This reduces dependency on cash and physical cards, making transactions quicker and more efficient.

2. Enhanced Security Through Tokenization

Security is one of the top concerns for digital payments. Google Wallet uses tokenization technology, replacing the actual card details with a randomly generated token. This ensures that sensitive card information is never exposed during transactions, reducing fraud risks and improving authorization rates.

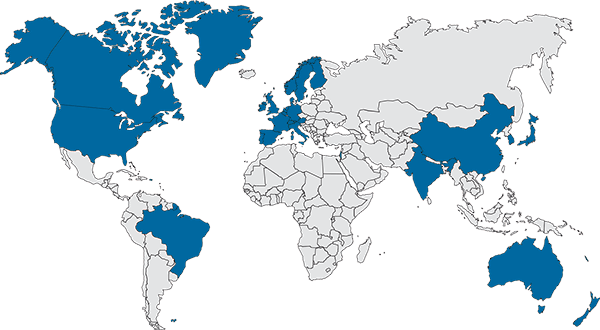

3. Global Usability

Pakistani Visa cardholders can now use Google Wallet while traveling abroad. Whether booking flights, paying for hotels, or shopping overseas, users can experience the same seamless payment process they enjoy at home.

4. Seamless Online Payments

E-commerce is growing in Pakistan, and Google Wallet simplifies the online payment process by enabling secure and fast checkouts. Users can link their Visa Cards to Google Wallet and pay online with minimal hassle.

3. Global Usability

Pakistani Visa cardholders can now use Google Wallet while traveling abroad. Whether booking flights, paying for hotels, or shopping overseas, users can experience the same seamless payment process they enjoy at home.

4. Seamless Online Payments

Ecommerce is growing in Pakistan, and Google Wallet simplifies the online payment process by enabling secure and fast checkouts. Users can link their Visa Cards to Google Wallet and pay online with minimal hassle.

Security & Tokenization Technology

Google Wallet’s integration with Visa relies on tokenization technology, a security measure that replaces the actual 16-digit card number with a unique token. This ensures that even if transaction data is intercepted, it cannot be misused by fraudsters. Other security features include:

- Biometric Authentication: Fingerprint or facial recognition for transactions.

- Device-Based Security: Only authorized devices can access and use Google Wallet.

- Transaction Monitoring: Visa’s fraud prevention system continuously monitors for suspicious activities.

Industry Reactions

Umar Khan, Country Manager for Visa Pakistan & Afghanistan:

"Visa’s collaboration with Google represents our commitment to enhancing Pakistan’s digital payment ecosystem. With this integration, we are making it easier for consumers to pay securely and conveniently. We believe this marks a new era in Pakistan’s financial technology landscape."

Farhan Qureshi, Country Director for Google Pakistan:

"Google Wallet will revolutionize how Pakistanis transact, travel, and shop. This launch highlights our long-term commitment to supporting Pakistan’s digital economy. With more people adopting digital payments, this initiative will further financial inclusion and unlock economic opportunities for all."

The Future of Digital Payments in Pakistan

With the enablement of Google Wallet, Pakistan is taking a crucial step toward a cashless society. Some key trends that will shape the future of digital payments in Pakistan include:

- Expansion of Digital Wallets: More banks are expected to integrate their cards with Google Wallet, expanding its accessibility.

- Rise of E-commerce Transactions: With a surge in online shopping, secure and quick payment options will play a crucial role in the digital economy.

- Government’s Digital Initiatives: Pakistan’s State Bank and financial institutions are actively promoting digital transactions to reduce reliance on cash.

- Growing Financial Inclusion: Millions of unbanked individuals are expected to benefit from digital payment solutions.

How to Add a Visa Card to Google Wallet

- Open the Google Wallet app on your Android or Wear OS device.

- Tap 'Add to Wallet' and select 'Payment Card'.

- Scan or manually enter your Visa Card details.

- Follow the on-screen instructions to verify your card with your bank’s authentication process.

- Once verified, your Visa Card will be ready for use with Google Wallet.

Key Notes

The launch of Visa card support on Google Wallet is a significant milestone in Pakistan’s financial sector. It aligns with the country’s growing digital transformation and provides consumers with a secure, efficient, and globally accepted payment method. With more banks joining the initiative soon, the future of digital payments in Pakistan looks brighter than ever.

Worldwide Visa Information for Pakistani Passport: